Peter Schiff Admits a Mistake In His Bitcoin Prediction

The implacable Bitcoin critic Peter Schiff admitted he was wrong in the July forecast of the collapse of the first cryptocurrency.

At that time, he hoped that this would happen against the background of the expected rise in gold to a historical maximum. In response to a reminder from one of its subscribers, Golden Beetle explained that he was right about the gold but wrong about Bitcoin. He attributed this to the influence of the Grayscale Investments ad campaign, which hinted at the intensive work of the Federal Reserve System printing press during the crisis.

#Bitcoin can just as easily be consolidating before the next breakdown. Consolidations after sharp moves typically continue the move that proceeds them. The more the 10K support level is tested the weaker it gets. Markets rarely give investors that many chances to buy the bottom.

— Peter Schiff (@PeterSchiff) September 6, 2020

The reason for reminding Schiff of the erroneous forecast was his new statements regarding the prospects for Bitcoin. In a discussion with one of the founders of the Gemini Bitcoin exchange Tyler Winklevoss, he said that he expects a breakdown of support at $10,000. The BTC critic perceives a rollback to this mark as the beginning of a new “bear” cycle.

Tyler Winklevoss assumed the first cryptocurrency would consolidate at $10,000 ahead of a new wave of growth.

#Bitcoin can just as easily be consolidating before the next breakdown. Consolidations after sharp moves typically continue the move that proceeds them. The more the 10K support level is tested the weaker it gets. Markets rarely give investors that many chances to buy the bottom.

— Peter Schiff (@PeterSchiff) September 6, 2020

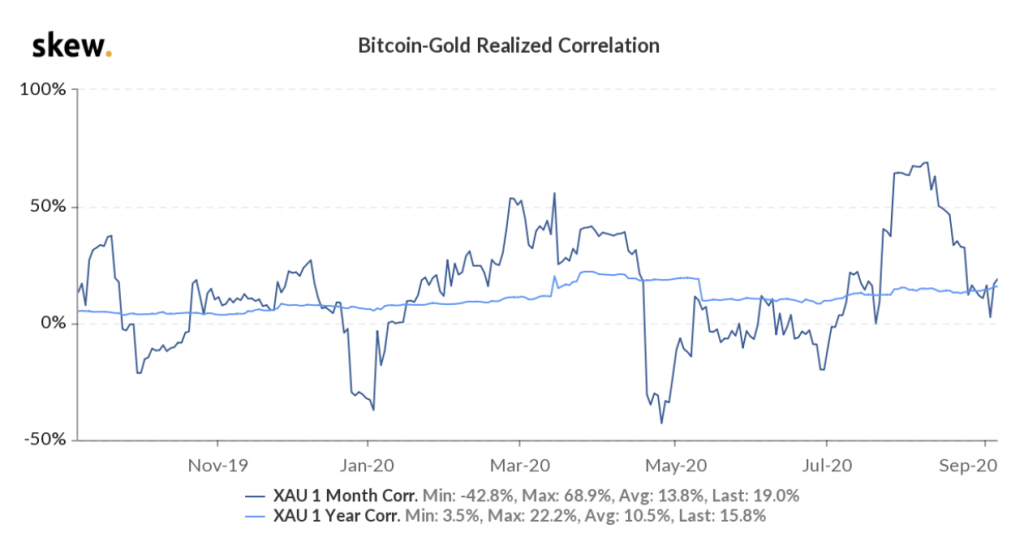

Explaining why the July forecast was untenable, Schiff also mentioned the increased correlation between gold and Bitcoin.

On August 7, the monthly realized correlation of the two assets peaked at 68.9%, according to analyst firm Skew. On September 4, this ratio dropped to 19%.

Another well-known trader and tech analyst, Peter Brandt announced the liquidation of all Bitcoins and other assets shortly before the deterioration in global market sentiment. Earlier, the co-founder of 10T Holdings and Gold Bullion International Dan Tapiero expressed confidence that the possible continuation of the correction in the stock market in the future will not affect the stability of gold and the first cryptocurrency.

Stay tuned with Software Focus!