InsurTech 2020: The Most Sought-After Startup Solutions

InsurTech is a niche of technological solutions applied in the field of insurance. Since 2010, there have appeared many startup solutions at the intersection of IT and insurance, and some of them are still extremely popular among investors now.

Let’s dive deep into what InsurTech products are in demand on the market now and how technology companies can attract investments for the development of this promising sector.

InsurTech Market in 2020

According to NTT Data, in 2019 InsurTech attracted more than $6.3 billion in investments. This is 53% more than in 2018. The USA and China are ahead of the curve in terms of InsurTech investments. And by the number of startups – the USA and Western Europe. As many as 90% of the invested funds were directed to the development of projects based on AI + Data or Cloud technologies.

Despite the growth in investments, a record low number of new InsurTech startups was recorded in 2019 – the number dropped to the level of 2016.

In the past, investments were received mainly by companies that have already entered the market with their own InsurTech product.

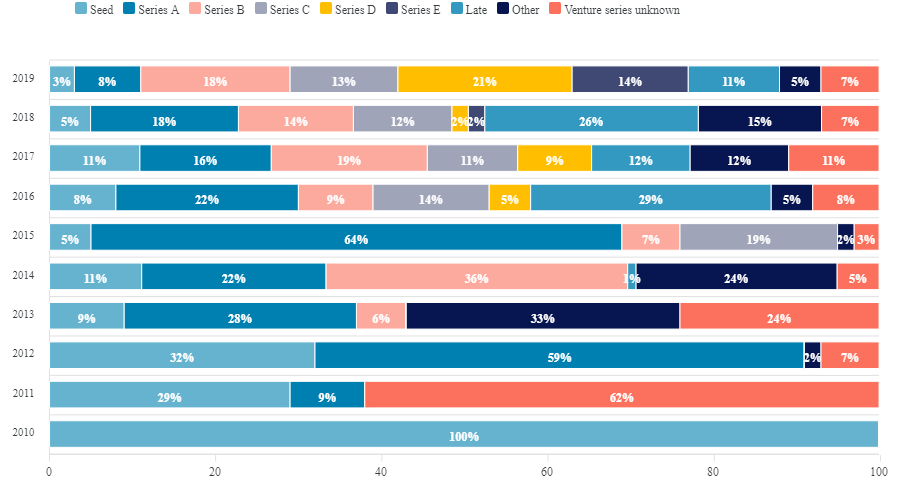

Over the past 10 years, the willingness of investors to invest in InsurTech projects at an early stage has changed markedly. If in 2010 up to 100% of investments were attracted to projects at the seed stage, by 2019 the picture has changed dramatically: only 3% of projects at the initial stage seek investor support.

In 2020, the trend for investing in InsurTech is gaining steam again. The first quarter saw a boom in startups and projects in the market, driven by the coronavirus pandemic. Activity eased slightly in the second quarter as the first panic expectations subsided.

In Q2 of this year, interest in InsurTech has grown again. The companies raised about $2.5 billion in 104 deals. Investors are showing more interest in companies already on the market in the latest rounds of investment.

69% of all funds were attracted by six large companies in InsurTech:

- Bright Health ($500M)

- Ki ($500M)

- Next Insurance ($250M)

- Waterdrop ($230M)

- Hippo ($150M)

- Policy Bazaar ($130M)

But at the same time, investors are still ready to invest in startups in the early stages of attracting investments – the share of transactions at an early stage in the third quarter increased to 57%.

What InsurTech Products Are Worth Investing In 2021

On-demand insurance applications

These are systems and platforms for personalized offers. Consumers want packages and insurance programs that are tailored to their individual needs. Therefore, one of the promising areas is projects that make up unique insurance programs based on user-specified criteria.

AI systems for insurance projects

These can be services that help insurance companies calculate risks or make forecasts. Or helper applications for calculating premiums and payments. The same category may include applications that prompt the user to classify insured events depending on the description of events or the size/nature of the damage caused.

P2P Projects, or “Friendsurance”

These are services or platforms based on the equal interaction of users. That is, a user does not purchase a policy from an insurance company but combines it with other users with similar risks and interests to create their own insurance mechanism, without involving an agent. A group of users can independently form an insurance fund and determine the conditions under which participants can use its services.

Simplify-Projects

These are systems that will make it easier for the user to choose an insurance policy and help to understand the terminology.

Such projects are especially relevant for the field of life and health insurance since it is extremely difficult for an ordinary user to understand the abundance of medical terms and classifications of health loss.

Projects and applications are designed to convey information in a simplified form and in an understandable language so that the user can independently figure out the nuances of insurance offers without the involvement of lawyers and consultants.

Stay tuned with Software Focus!