Cryptocurrency Whale Trade Size and Key Exchanges

Software Focus recaps the findings of the recent Analysis of Cryptocurrency Whale Trade Size and Direction by Kaiko Data.

The number of Bitcoin Whales has approached the level of September 2017, when BTC reached its all-time high of $20,000. The value BTC has been steadily growing since the beginning of the year, which indicates the accumulation of digital gold by large market players, possibly on the eve of new price spikes. However, not all whales adhere to the Buy & Hold investment strategy. This means that a significant number of large transactions are performed on cryptocurrency exchanges, affecting the price of BTC and the market as a whole.

Kaiko Data researchers have analyzed the trading data of the largest crypto exchanges, focusing on the “whale” transactions.

Key Takeaways

- Most of the big deals take place on OKEx. This exchange is characterized by the largest trading volume and significant size of the “whale” transactions.

- On the “institutional” exchange LMAX Digital, the largest average transaction volume is 0.69 BTC. This is about twice as much as Bitstamp (0.37 BTC).

- OKEx, Binance, and Huobi have relatively low average trade volumes. These exchanges, which are predominantly focused on retail players, have large-value whales.

- BTC/USDT have more whale deals than BTC/USD.

The profiles of the cryptocurrency market participants range from the smallest traders to the real whales. Many exchanges target different categories of traders through targeted marketing and trading options to differentiate themselves in a competitive environment. After conducting their research, Kaiko Data has found that each of the exchanges has its own unique structure of transactions, sometimes quite unexpected.

Methodology

Researchers have selected a number of exchanges with significant trading volumes. These marketplaces target different user groups bases on geography, active trading pairs, regulatory considerations, and industry reputation in general. The study used data for June 2020 from 11 crypto exchanges and trading pairs with the highest volume:

- Binance (BTC/USDT);

- Huobi (BTC/USDT);

- Bitstamp (BTC/USD);

- Coinbase (BTC/USD);

- Bitfinex (BTC/USD);

- Kraken (BTC/USD);

- Liquid (BTC/JPY);

- OKEx (BTC/USDT);

- Bitflyer (BTC/JPY);

- LMAX Digital (BTC/USD);

- Gemini (BTC/USD).

A deal is considered a “whale” if its size exceeds 10 BTC.

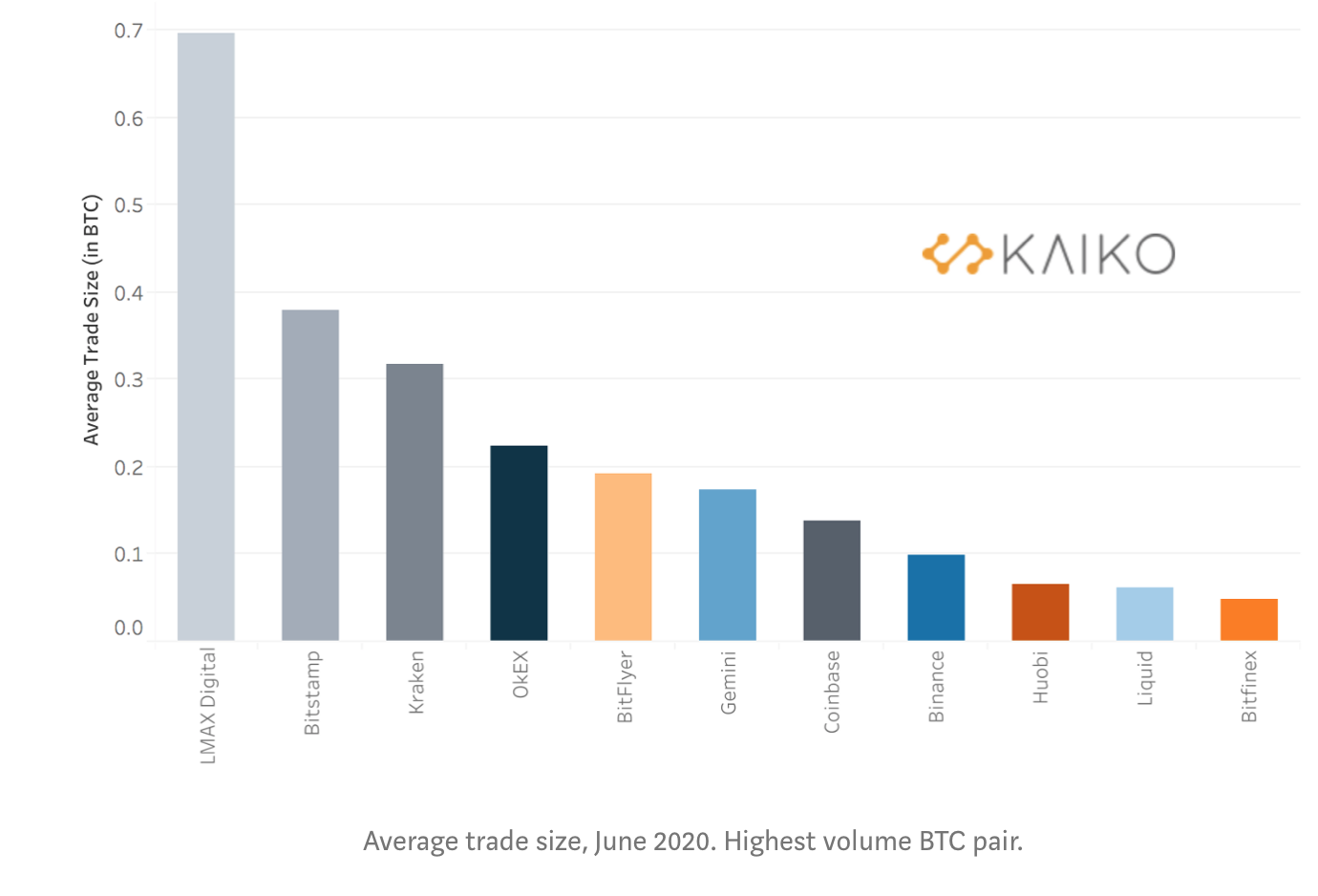

Average Trade Size

LMAX Digital was found to be the leader in average trade size at 0.6968 BTC. This is an expected result since the exchange is almost entirely institutional-oriented. The average order size on LMAX Digital is roughly double that on Bitstamp (0.3783 BTC), which ranks second in the ranking. Interestingly, on Bitstamp, this figure is more than double that of its closest competitors – Gemini (0.1739 BTC) and Coinbase (0.1373 BTC).

On Binance, Huobi, Liquid, and Bitfinex, which are mainly focused on retail traders, the average trade size is even lower – 0.0997 BTC, 0.0653 BTC, 0.0612 BTC, and 0.0481 BTC, respectively.

Huobi is the leader in the number of transactions in the BTC / USDT pair (~ 16 million).

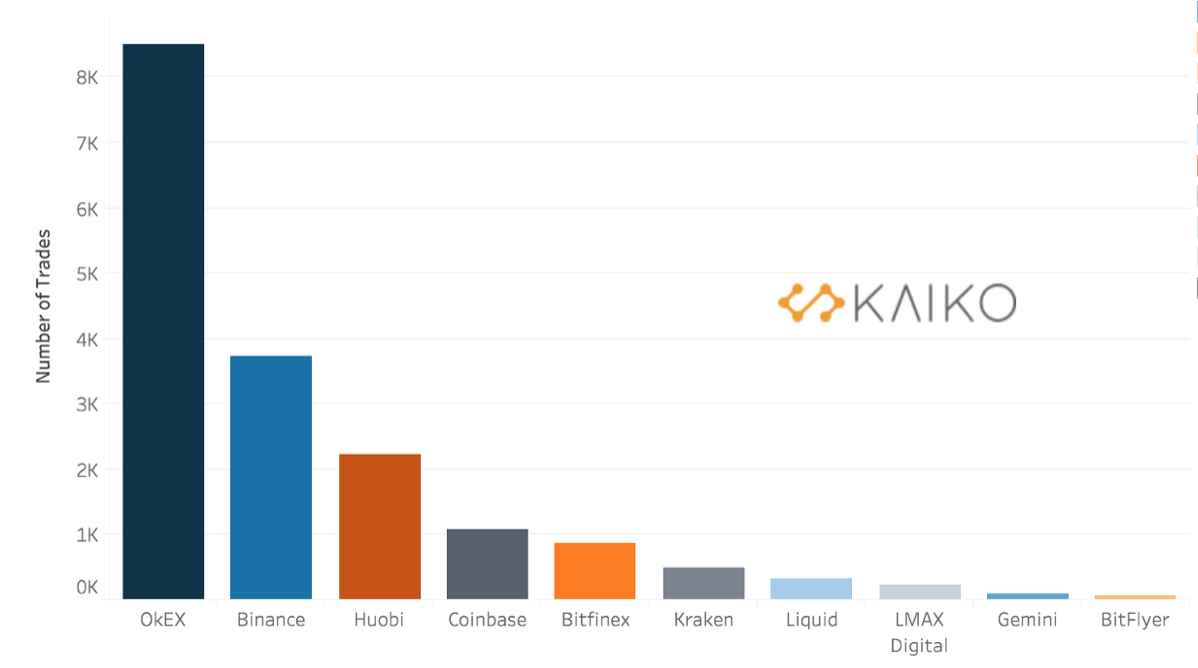

Total Trade Count

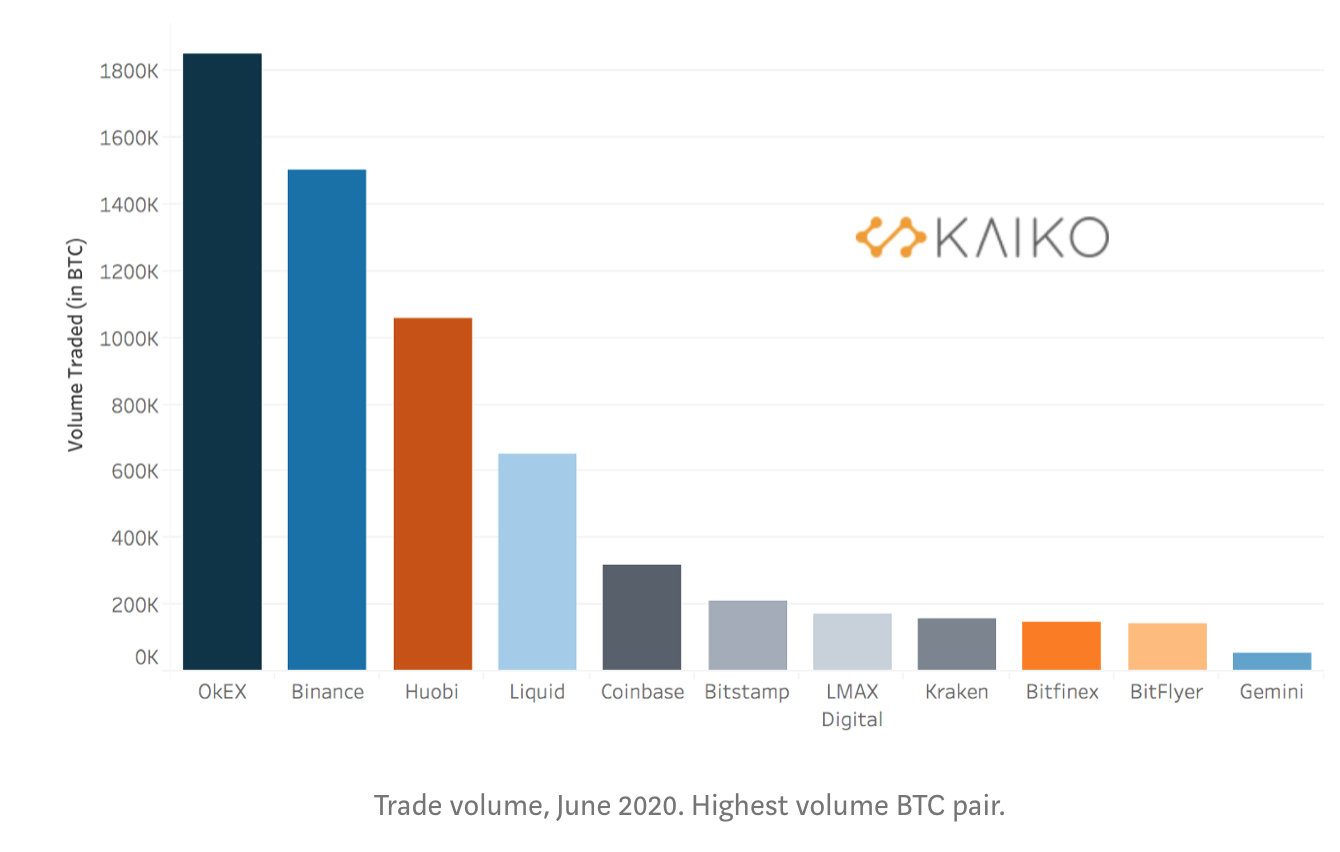

In terms of the number of transactions, OKEx ranks fourth, but it ranks first in terms of the total trading volume. where it significantly outperforms three other trading platforms focused on retail traders.

Total Trade Volume

Interestingly, the BTC / USDT pair has the highest trading volume. Coinbase, Bitstamp, Kraken, Bitfinex, LMAX Digital, and Gemini, where BTC / USD was taken into account, had significantly lower volume and number of transactions.

Number of Whale Trades

Conclusions

OKEx leads the market in terms of whale trades and average large order size. The total trading volume on this exchange is one of the largest in the industry. Consequently, the exchange plays a significant role in price formation. Large players prefer high volume exchanges. This is logical – liquidity is important, as it prevents price slippage in large trades.

There are more whale trades on the exchanges that support the BTC / USDT pair than on the trading platforms with the BTC / USD pair. Many large transactions are made on exchanges on a regular basis. This may indicate the high liquidity of the order books.

The distinction between retail-oriented and institutional-focused platforms is blurred. The “retail” exchanges have a significant user base, regularly making large transactions.

Get more insights from the original report!